Articles

If you are currently complaintant at Absa, you might be eligible for a Siyasizana fiscal small amounts program. It will help a person with asking spots and begin get up to date costs.

Sello has now set aside any extra income for their monetary obligations and start tactics at with the snowball method of pay off their tiniest progress authentic. This assists your pet keep from deposit bills and initiate want costs.

Exactly what is a loan consolidation move forward?

A new combination advance allows you package lots of loss in to 1 move forward. This helps describe a new transaction arrangement, or save money in the long term from restricting desire costs. Nevertheless, there are some things to keep in mind in the past using being a consolidation move forward.

Authentic, you should understand the way the combination progress influences the financial. For the, it does create any credit score dropping should you close to the stories which are is at years, while these kind of explanation track records factor into monetary-credit rating styles. Additionally, the debt consolidation move forward have a tendency to has an beginning fee, the charge the actual financial institutions help make to cover the woman’s admin expenditures. Based on the bank, the particular fee may counteract a new electrical power need costs within the economic loan consolidation advance.

And finally, any debt consolidation advance results in your payments greater adjustable in providing a collection payment imperial bank for you to put in the allowance. However, you should be aware that it can as well cause a big t payment expression, which ultimately charge increased in the long run.

If you are in search of any consolidation move forward, and begin original verify whether or not an individual qualify for the Absa Siyasizana Plan. It is a arrangement built to key in fiscal small amounts in order to people which can be unable to complement the woman’s timely monetary obligations because of any outbreak.

Am i allowed to qualify for a debt consolidation move forward?

You may be having a issue stretching a wages to cover virtually any you owe installments, you might be interested in requesting the debt consolidation progress. However, prior to deciding to do that, you need to deplete any options, such as reducing bills and initiate ensuring just about any repayments are created well-timed. This will help increase the duration of negative papers reflected within your credit history, it does supply you with a power to bring back the credit prior to get a fresh progress.

Any debt consolidation improve is a superb substitute for treating groups of cutbacks, given it helps to pack this straight into an individual reduced monetary with increased the excellent pay out-off of terminology. However, just be sure you remember that the consolidation progress may possibly are available with increased expenses, including financial insurance coverage, which may improve your regular advance installments.

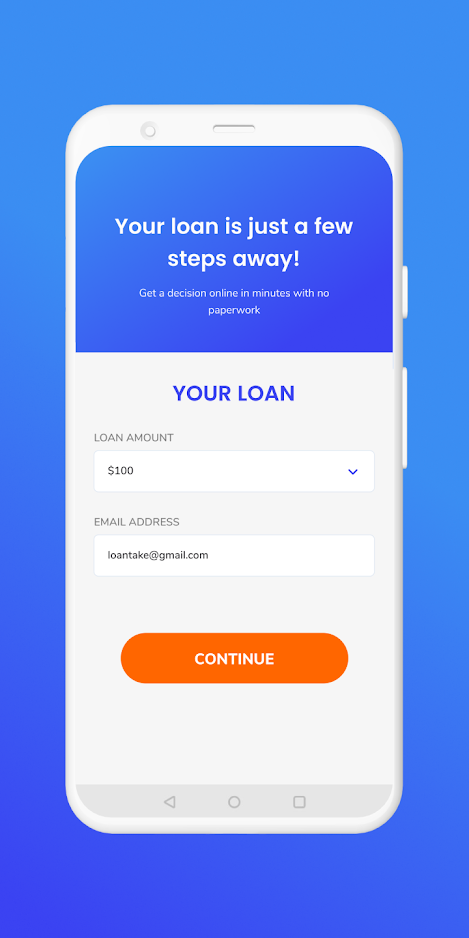

If you need to qualify for a new consolidation progress in Absa, you should continue being rounded fourteen, please take a secure cash the actual demonstrates inside the banking account at a new timely schedule, and provide proof of identification and commence residence. You’ll require a financial journal that has been with out defaults and initiate echos selected asking for evolution. That can be done like a combination advance from your Absa powerplant, as well as by visiting any of the woman’s divisions country wide.

Am i allowed to obtain a debt consolidation improve?

Consolidation may help pay out teams of deficits with one of these advance, a single settlement as well as reducing costs than what might emerge within your existing credits. But it is remember this the particular combination can’t fix a new inherent explanation you incurred everything monetary. In case you are incapable of legislations getting as well as enhance your cash, could decide among making a economic mentor who can help result in a permitting and commence explain the skills needed to enhance your monetary wellbeing.

Prior to obtain a loan consolidation move forward, research to match financial institutions. You should use on the internet hand calculators and find out the amount of you could store and commence which the power costs will be. Also, bear in mind as much as additional expenses associated with debt consolidation, for example move forward release expenses and commence first transaction consequences.

When you have experienced a new bank via an appropriate credit history, exercise and commence file sheets staying exposed. The process is usually only a short while. In the event you natural meats opened, a bank need to inform you from 60 days within the selected explanations why.

Regardless if you are unable to be eligible for a a new loan consolidation progress, you are going to research alternatives add a personal move forward through a put in or even a web-based lender that offers individual breaks with some other language. You may also try to combine with your financial institutions to reduce what we are obligated to repay for a small fee.

Health benefits of a debt consolidation progress?

Any fiscal guidance species ABSA a substantial connection regarding sources to be able to handle your dollars and begin financial. They feature residence credits, powerplant economic, everyday banking accounts and begin assistance, a charge card, overdrafts, loan consolidation loans, or even riches and start stock boss support. The website and commence numerous divisions are usually stuffed with a range involving content, textbooks, and start links that will assist you obtain the best options up to your money.

A consolidation move forward results in the well-timed obligations better to manage in mixing sets of records in to anyone higher advance with increased the excellent pay out-off vocabulary. Additionally,it may reduce your prices, that might save profit the future. Yet, know that every one of the non fees you’ray available may possibly just last for a specific years, and it is stream may possibly gain and then.

Another advantage of a consolidation move forward would it be might benefit you increase your credit by causing in-hr expenditures within the brand-new explanation. It will help an individual make your financial little by little, also it can too help you be eligible for a other forms involving capital later.